“The LASIK market shows that it is beholden to the Consumer Confidence Index,” says Shachar Tauber, M.D., corneal specialist and director of ophthalmic research at St. Johns Health System, Springfield, Mo. “Despite advances in knowledge, along with advances in pharmaceuticals and technology that have improved the quality and safety of this procedure, we are in the midst of a great downturn in LASIK volume. We have seen many practitioners and corporate providers exit from markets throughout the U.S.”

Fortunately or unfortunately, my experience in the LASIK marketplace serves as a good chronicle of where the market has been, and where it may be headed.

|

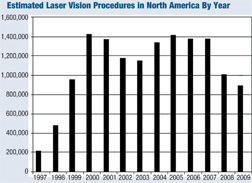

| Laser vision correction procedures reached a peak in 2000,

and declined sharply with the economic downturn in the past two years.

Source: Briefing.com |

While I enjoyed treating ocular disease and working with athletes, my strong suit was in helping patients see sharp and clear. Up until 1995, this consisted of prescribing glasses and contact lenses. Suddenly, with FDA approval of the first excimer laser, the possibility of refractive surgery eroding my practice base seemed surprisingly possible. During this same time, I was part of a local group of optometrists who worked with an ophthalmologist within our practices. We decided to take the risk and opened a jointly owned laser center in Sacramento, beginning operations in September 1996. Within six months, we were profitable. By spring of 2000, we had opened 10 Pacific Laser Eye Centers throughout California and Nevada. Each center was 49% locally owned by a large number of optometrists and a few ophthalmologists in each region. Particularly exciting were the openings of a Pacific Laser Eye Center at both Southern California College of Optometry and the University of California, Berkeley, School of Optometry. By late 1999, we had incorporated a management company in order to oversee the burgeoning business.

The centers were growing, and we had a model that worked well integrating the skills of optometrists and ophthalmologists, while providing high-level care to our patients within our practices. Laser vision correction volumes nearly doubled during each year from 1996 through 2000. We were excited at the growth, and thrilled to have entered the market early and at the right time. In 2000, LASIK volumes skyrocketed to more than 1.4 million procedures in the U.S. The transition from PRK to LASIK had been brilliant—with patients reporting little pain and discomfort, and a “wow!” factor at the one-day postoperative visit. Insiders predicted that the market would top 2 million procedures at some point between 2002 and 2006.

Unfortunately, a confluence of factors struck with a vengeance—a catastrophic pricing war, the burst of the “tech bubble,” and the September 11 terrorist attack. Suddenly, what seemed so rosy and upbeat was looking like an overreach into Alan Greenspan’s “irrational exuberance.” LASIK volumes sank. Beacon was taken over by TLC, and both LASIK Vision of Canada and Aris Vision closed. The stock market dropped precipitously. Fearing the market may take years to come back, Pacific Laser Eye Centers’ board decided to sell or close five of our centers. Looking back, 2000 procedure volumes still stand as the high water mark for laser vision correction procedures.

|

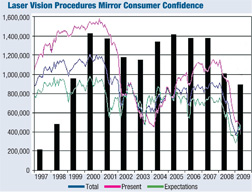

| Estimated laser vision procedure volumes in North America

have tracked fairly closely with consumer confidence ratings (red line).

Source: Briefing.com |

David Harmon of MarketScope (which tracks the ophthalmic laser vision marketplace for investment analysts) noted that procedure volumes tracked fairly closely with consumer confidence ratings. Consumer spending accounts for about two-thirds of the U.S. economy, so it has an enormous influence on our market. During good times, consumer confidence levels can soar to more than 100 ranking points. For many years, the index ranged between the upper 70s and low 120s. The lowest point in recent memory was in 1991, after the recession that was precipitated by the onset of the Gulf War. At the time, consumer confidence fell to a “historic low” of 55.3.

More recently, consumer confidence had fallen to the low 60s in June 2008, a 20-year low. The financial meltdown spooked consumers, bankers, politicians and investors alike. Consumer confidence then fell from 61.4 in September 2008 to 38 in October, its third-largest individual drop. By February 24, 2009, consumer confidence hit an all-time low of 25—its lowest point since the index was launched in 1967—followed by a similar low in March. Into the Maelstrom The vengeance with which the drop in consumer confidence struck was a bellwether to the devastation of the LASIK marketplace. LASIK Plus reported a 51% drop in the fourth quarter 2008, and a 37% drop in the first quarter 2009. TLC, in its 2008 earnings report, announced the company lost $98 million on revenue of $276 million, compared to a loss of $42 million on revenue of $298 million in 2007.

First quarter results in the LASIK industry are the most important of the year, and usually greater than the remainder of the year. Patients have the opportunity to utilize tax-free dollars through their flexible spending accounts (FSAs). With both TLC and LasikPlus reporting substantive losses, this creates major challenges for the upcoming, typically lower volume, months ahead. The Optometric Council on Refractive Technology (OCRT) has a membership that is active in refractive surgery. Almost all members have reported that their center volumes are down significantly. Imagine how you would cope if your gross revenues were off 40% to 50%—within a matter of months.

“We have been down anywhere from 15% to 90% since the financial meltdown began last September,” says Greg Moore, O.D., clinical director of the West Virginia Laser Eye Center. “Unfortunately, now consumer confidence is gone. The problem, as I see it, is not one so much of economic disaster causing a loss of disposable income as much as it is a fear of economic disaster causing a hoarding of disposable income.” Dr. Moore says the best example of this was a week in early October 2008, when 11 clients who were scheduled for evaluations cancelled the day the stock market dropped 700 points. “We have not had anything like that ever—even after the attacks on September 11,” he says.

To tackle this, his centers are moving into a new direction. “Within the next two months, we should be offering additional and, more importantly, insurable surgical services,” Dr. Moore says. “If you offer only one type of service, and you do not find other recession-proof revenue streams, you will not likely weather this storm.”

What Does the Future Hold?

Recall the strong economy before 2008—the housing bubble seemed unbreakable. Meanwhile, refractive procedures became more reliable. Yet refractive surgery volume reached its peak in 2000. And procedures actually dropped from 2005 onward. Why didn’t the LASIK market grow during these years when the economy was robust and awash in refinance dollars? What other factors kept procedure volumes stagnant over the period from 2005 to 2008? What is a realistic forecast for LASIK volumes in the near future and onward? There are a number of factors that come into play.

First, contact lens technology has improved markedly during the past decade. Secondly, the accommodative IOL and multifocal implants have provided new avenues for ophthalmologists to pursue. As the LASIK market has tightened and stagnated, the growth in premium IOLs has increased.

“Most everyone in our segment of the industry agrees that LASIK is indeed discretionary spending, and therefore it has been cut out of many consumers’ ‘to do’ list for the foreseeable future,” says Blake Michaels, Alcon’s Regional Refractive Director, Western U.S. “As confidence increases, volumes should return to successful practices. Will they return to pre-2008 run rates? No one knows, but most experts believe that will not be the case in 2010.”1

MarketScope, our industry barometer, noted in its August 12, 2009 newsletter, Ophthalmic Market Perspectives, “Persistently low consumer confidence and tight credit continued to severely reduce demand for refractive surgery in Q2-2009, especially when compared to a relatively robust Q2-2008. Six quarters of double-digit volume declines has begun to take a severe toll on U.S. laser vision surgery providers and led to record number of laser center closures. Although there are some signs of improvement in the economy, continuing high rates of unemployment and economic stress are expected to dampen consumer confidence and restrict demand for vision correction surgery for the balance of 2009. U.S. laser refractive procedures declined 30.8% to 192,000 in Q2-2009 when compared with 277,000 procedures in Q2-2008.”

The Luxury of LASIK

Interestingly, other elective surgical procedures did not suffer near the same fate as LASIK during the economic downturn of 2001/2002, or even this year’s recession.2 While elective procedures overall went down in volume, the wide variance in LASIK pricing served to confuse consumers rather than attract them to great quality at a discounted price point. Pricing has certainly come down some, but not to the basement levels that resulted from panicked providers after the last economic downturn.

“The economy is in such flux that I think it’s hard to make any reliable forecast for a discretionary and luxury [expense] such as LASIK,” says Shareef Mahdavi, a medical device consultant who is widely credited with coining the term LASIK. “The only thing I can say for sure is that people are spending money, just being more selective in how they spend it. This puts the onus on LASIK providers to be more customer-centric and friendly. Typical doctor office behavior (poor phone skills, waiting room, and the like) just won’t cut it and probably never again will be tolerated.”3

Many consultants are pointing out the high degree of acceptance of LASIK surgery among the upcoming generations. As a comparison, orthodontic braces were a luxury at one time, but today they are often viewed as a rite of passage for early teens. Still, until the credit crisis passes and consumer confidence returns to more normal levels, the early twenty-somethings won’t hurry to embrace LASIK.

Weathering the Storm

The key will be to weather the storm. As Dr. Moore noted, it is important to add other services and procedures. Certainly, cataract surgery is much more recession-proof, but it necessitates an ambulatory surgery center. For example, LASIKPlus believes that as long as the market does not continue lower, it will be able to weather this economic downturn. To do so, the company announced in April 2009 that it would begin to offer eye care for patients beyond LASIK evaluations and postoperative care. The new program will also “allow us to more fully utilize the highly trained and skilled ophthalmic surgeons and optometrists within the company,” the company said. The reality is that refractive surgery will not be going away anytime soon, and optometrists need to see LASIK and accommodative and multifocal intraocular lenses as additional opportunities to participate in their patients’ vision care.

“Today, the outcomes from laser vision correction are better than ever, so optometrists need to continue to mention the procedure to all eligible patients. Also, it is an opportunity for optometry to get involved with the premium IOLs,” says OCRT President Jim Owen, O.D., M.B.A.4

Business consultant Gracie Pimental, M.B.A., says, “The economic downturn is an excellent opportunity for all practices to evaluate their existing profit centers of LASIK, premium IOLs and optical. Take this opportunity to streamline processes, improve customer service, and to increase patient referrals and hence profitability from your existing patient base.”5

The state of LASIK is incredibly challenging for many. Staffing in many LASIK centers has been cut back dramatically, with no certainty of weathering the storm. My company, PLEC Management Group, Inc., was not so lucky. As revenues and procedure volumes plummeted, we were unable to react quickly enough. Soon, we went from being current on all our bills to being behind to many of our referring optometrists and surgeons. Unfortunately, while most of our centers are valiantly attempting to ride out the storm, the management company has had to file for bankruptcy. The good news in all this is that the demand for eye care and optometric services—including LASIK and premium IOL cataract surgery—should afford the optometric practice to not only survive this economic downturn, but also to position itself for significant growth over the next few years. On a hopeful note, consumer confidence rebounded in May 2009 to 54.9, its highest level in eight months. As of mid-August, the Index was at 54.1, up from a dip of 47.4 in July. In September, a similar index, the Reuters/University of Michigan Index of Consumer Sentiment, increased to 73.5—the highest since the beginning of 2008. In the next two decades, for example, there may well be more demand for ophthalmic surgical procedures in the U.S. than there are surgeons to provide the surgical care.6 This is, in part, why a keynote speaker at the recent Academy of Ophthalmology meeting pointed out the importance of ophthalmologists working more closely with optometrists.7 Dr. Fuerst, formerly CEO for Pacific Laser Eye Centers, is now in a multi-doctor practice near Sacramento, Calif. He is also president of a biotech firm, Ocugenics, LLC., and president of Vision of Hope, a charity providing vision care to underprivileged children.

1. Personal communication.

2. American Society of Plastic Surgeons website. 2008 Plastic Surgery Procedural Statistics. Available at: www.plasticsurgery.org/Media/Press_Kits/Procedural_Statistics.html (accessed September 13, 2009).

3. Personal communication.

4. Personal communication.

5. Personal communication.

6. Manpower needs, shortages altering primary care in ophthalmology practices. Ophthalmology Times. Nov 12, 2007. Available at: http://ophthalmologytimes.modernmedicine.com/ophthalmologytimes/2007+AAO+News/Manpower-needs-shortages-altering-primary-care-in-/ArticleStandard/Article/detail/472356 (accessed October 1, 2009).

7. Fineberg H. 2008 opening session keynote address. American Academy of Ophthalmology website. Available at: http://209.235.196.86/meetings/annual_meeting/keynote.cfm (accessed October 1, 2009).