| How the ACA Affects You, the Small Business Owner

For years, small business owners—such as optometrists who own private practices—didn’t have the leverage that large corporations had to negotiate better health insurance coverage and pricing for employees, leaving their staff members either underinsured or uninsured. The ACA definition of a small business is one that has the equivalent of 50 or fewer full-time employees. These businesses are not required to offer or contribute to their employees’ health insurance—but do qualify for tax credits when they contribute to their employees’ health coverage. The tax credit is worth up to 50% of the contribution toward employees’ premium costs. The smaller the business, the bigger the credit. The tax credit is highest for companies with fewer than 10 employees who are paid an average of $25,000 or less. To qualify for the Small Business Health Care Tax Credit, you must: • Have fewer than 25 full-time equivalent employees making an average of about $50,000 a year or less. • Pay at least 50% of your full-time employees’ premium costs. (You don’t need to offer coverage to your part-time employees or to dependents.) • Purchase your employees’ health insurance through the Small Business Health Options Program, a marketplace much like the health care exchanges offered to individuals. Plans offered on SHOP have the same 10 essential health benefits as those on the individual exchange. (If you’re self-employed and have no employees, you don’t use SHOP. You’d get insurance through the individual health exchange marketplace. Also, larger businesses that have more than 50 full-time equivalent employees with average wages above $250,000 must provide full-time employees with health insurance in 2015.) From a business perspective, the cost of employee turnover can never be recouped in any business model, so offering quality, affordable health care to your employees can help reduce turnover to a minimum. For more information, click here. |

||

Indeed, the questions and confusion had only just begun. Lawmakers, providers, patients and managed care companies have been scrambling to prepare for the biggest overhaul in health care since 1965, when Medicare and Medicaid were introduced. As recently as a couple months ago, President Obama and the Department of Health and Human Services came under fire for the initiative’s poorly functioning website, HealthCare.gov.

Despite a rocky start, the program is picking up steam—as of January 1, more than 2.1 million Americans had enrolled for coverage. And, before HealthCare.gov even launched, Americans were already benefiting from the early provisions of the ACA:

• Young adults under 26 years of age can remain on their parents’ health care plan.

• Children with pre-existing conditions can’t be denied coverage.

• Small businesses can receive tax credits for contributing to their employees’ health insurance.

• Patients have the right to appeal health care plan decisions.

• Insurance companies are prohibited from imposing lifetime dollar limits on essential benefits, like hospital stays.

• Preventive services—such as immunizations, annual physicals and screenings—are covered on all new plans.

Still, 2014 poses the biggest, most anticipated, and most controversial changes from the ACA yet. These changes have tremendous opportunity for optometrists, but they must be proactive with the upcoming changes. For instance, 17 different vision plans enrolled 48% of adults in 2012, but only one out of three members had an eye exam. With the expected influx of even more patients, there’s plenty of opportunity to further educate them about the importance of comprehensive eye examinations.

Now, to compete in today’s changing health care arena, practitioners must be able to react, educate and market to continue growing their practices.

1. Essential Health Benefits

The ACA requires that health care plans provide 10 essential health benefits (EHB) to standardize the minimum coverage offered to patients. These essential health benefits were written to protect patients from insurers that sold plans of sub-par coverage, which could leave patients in financial ruin if something catastrophic happened to their health. These benefits must be included for a plan to be certified to compete on the health care exchanges.

The 10 EHBs are: ambulatory patient services; emergency services; hospitalization; maternity and newborn care; mental health and substance use disorder services (including behavioral health treatment); rehabilitative services and devices; prescription drugs; laboratory services; preventive/wellness services and chronic disease management; and pediatric services, including dental and vision care.

• How to plan: For optometrists, the most important of these is the pediatric vision care benefit. The Department of Health and Human Services predicts that more than 8 million children could gain from this essential health benefit.

The pediatric vision care benefit includes an annual comprehensive eye exam, treatment and materials from birth through age 18.

However, the ACA language is vague about exactly what this benefit should entail; individual states can define the actual coverage using current vision plans as a benchmark, so coverage will vary from state to state. Some plans may include devices and materials; some may only include services. (Because of this law’s vague language, there is still a good deal of confusion and many unknowns.) Eyeglasses and contact lenses may be at least partially covered and exempt from the 2.3% excise medical device tax.

Also, the ACA mandates that there should be no annual limit on any EHB. Plans that have an allowance—in which employees are given a specific amount to apply toward eyewear products of their choice and have the option to pick high-end materials with add-ons—may run up against this mandate. So, expect different interpretations of the no out-of-pocket limit rule.

Although the ACA does not specify exactly which services—let alone tests and treatments that will be reimbursed—it is expected to follow the FEDVIP (Federal Employees Dental and Vision Insurance Program) plans. FEDVIP programs vary by state, along with the coverage and allowances for eyewear and contact lenses. Different insurance carriers offer different allowances for products. For example, Aetna, VSP, United Healthcare and Blue Cross Blue Shield offer FEDVIP plans; consult their reimbursement schedules for products and services to help you prepare for the EHB changes.

Understanding and planning for EHB is just the start of how you can prepare your practice for 2014. It’s more important than ever to market internally to your existing patients about these new benefits. Educate parents about the importance of yearly pediatric eye exams and the services your practice offers.

Also, market externally by building partnerships with your local PCPs and pediatricians to demonstrate your expertise and concern with this demographic. Partner with local philanthropic clubs and schools, and volunteer to perform vision screenings to uncover hidden refractive and binocular disorders, helping your practice capture this emerging market share.

2. Health Care Exchanges

The health care exchanges were set up as a marketplace for consumers to shop, select and purchase certified health insurance. The key word is certified so that, as mentioned before, all plans available on the exchanges have the 10 EHBs. Now, because all plans must have the same basic coverage, the exchanges should increase competition, streamline administrative costs and eliminate discrimination of individuals with pre-existing conditions. This methodology was designed to improve efficiencies and reduce waste, with the goal of lowering health care costs.

| State-Run Health Insurance Exchanges

Most Americans can use HeathCare.gov to access the health insurance exchange in their state. States that administer their own exchange marketplaces include: California: www.coveredca.com Colorado http://connectforhealthco.com Connecticut: www.accesshealthct.com District of Columbia: https://dchealthlink.com Hawaii: www.hawaiihealthconnector.com Idaho: www.yourhealthidaho.org Kentucky: https://kyenroll.ky.gov Maryland: www.marylandhealthconnection.gov Massachusetts: www.mahealthconnector.org Minnesota: www.mnsure.org Nevada: www.nevadahealthlink.com New Mexico: http://bewellnm.com New York: https://nystateofhealth.ny.gov Oregon: www.coveroregon.com Rhode Island: www.healthsourceri.com Vermont: www.vermonthealthconnect.gov Washington: www.wahealthplanfinder.org |

If you did not receive health insurance from an employer or were self-employed, you had to purchase health insurance on your own. Individuals and small businesses didn’t have the opportunity to negotiate pricing, have a portion subsidized from an employer, or be placed in certain risk pools. Instead, premiums were determined by health, age and pre-existing conditions.

With the implementation of the ACA, the exchanges now treat individuals and small businesses like corporations by grouping them together to receive certain discounts. Having the public exchanges allows individuals to compare plans and choose according to coverage and prices.

Plans are categorized in tiers: bronze, silver, gold and platinum. As you go up in tier, the pricing reflects additional coverage and lower deductibles. Once an individual has selected a plan, additional insurance (such as dental and vision) can be added. Remember, pediatric vision coverage is included with plans on the exchanges, so individuals older than 18 have to add vision insurance separately if they want additional coverage.

If you’ve visited the exchanges, you may have noticed that the traditional vision plans—such as VSP, EyeMed, Davis Vision, etc.—are not listed. There is a reason for this: Vision plans do not provide ALL 10 EHBs, so they’re not considered certified health care plans. Instead, vision insurance providers had to partner with other insurers to provide the vision portion of their plans on the exchanges.

• How to plan: Even though it has been difficult to access the exchanges and purchase health insurance, practitioners should be aware of which insurers are participating in their respective states. Some exchanges are state-run, and may be easier to access than those that are federally administered. (See “State-Run Health Insurance Exchanges,” left.) Not all insurers are listed on the exchanges, but the ones that are listed have agreed to participate and have their plans certified.

If you are not currently a provider under the health care plans listed in the exchange, contact the insurance companies that are participating to become credentialed on their panel. All new contracts should coincide with the Harkin Amendment, which states that health care providers (including optometrists) cannot be discriminated against participating, as long as they practice within their state regulations.

3. Medicaid Expansion

The ACA expands eligibility for the Medicaid program.

Medicaid began in 1965 as a mandatory federal and state program to provide basic medical and dental services for individuals with limited resources and low incomes. Funding is shared and based on each state’s per capita. States determine certain methodologies and rates for payment and reimbursement, and choose providers to participate in the program.

Because states have joint input regarding guidelines, eligibility varies. Most use similar eligibility guidelines for low-income adults under 65, unless they qualify in another eligibility group: children under 18, pregnant women, parents, the elderly or those with a disability.

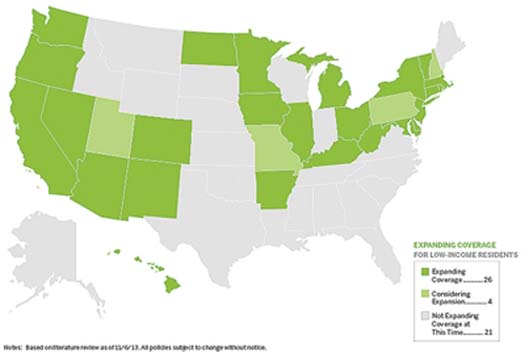

The ACA has now redefined eligibility and expanded it to all states. The federal government is funding 100% of the expansion for the first three years, then 90% afterwards. (States still have the option to opt out of the expansion without losing their funding; indeed, 21 states—including Florida, Georgia, Texas, Virginia, Wisconsin and the Carolinas—are not expanding Medicaid coverage) With the new expansion, it’s estimated that more than half of the uninsured will have access to Medicaid, including childless adults and everyone who is under 133% of the federal poverty line. (To view these groups, click here or here).

• How to plan: Optometrists are already highly involved in the Medicaid program, so with the Medicaid expansion we can expect an increase of patients. Check your state’s Medicaid website to see if it participates with the ACA Medicaid expansion and the state reform provisions. (Go to Medicaid.gov to connect to your state’s Medicaid site.) To accommodate the influx of new patients, and any additional mandates, make sure that your practice is running efficiently and productively.

If you don’t participate in the Medicaid program, visit your state’s Medicaid website to learn how to become a Medicaid provider.

While there is more federal funding to cover the additional uninsured, there is also an expansion of increased payments (similar to Medicare) for primary care physicians. However, optometry is not included in the specific definitions, so it’s our responsibility to change that. Currently, the Optometric Equity in Medicaid Act (HR 855), supported by the American Optometric Association and state optometric associations, has been proposed and is gaining endorsement. If passed, it will require coverage under Medicaid to include optometrists as providers of medical and other eye health services, under the scope of each state.

The ACA presents optometrists with new opportunities like never before. The business-as-usual idea is gone and ODs must now embrace this new world of health care. All modes of practice—private vs. corporate, independent contracts vs. employed, primary care vs. tertiary care—are faced with new challenges for 2014, but how you transform your practice can raise the bar not only for the profession, but also in patient care. How you modify your business model can point you toward success.

| Medicaid Coverage Expansion Map of the United States

Thanks to the Affordable Care Act, 25 states and the District of Columbia are expanding Medicaid eligibility. |

|

| Source:

The Advisory Board Company

|

Dr. Rogoff is an independent practice consultant with expertise in areas of health care, business and operational management. He is also the partnerships and marketing liaison for the Maryland Optometric Association. Thanks to Jon Hymes, interim executive director of the American Optometric Association, for providing information for this article.